tax forgiveness credit pa

If your Eligibility Income. Economy Education National Issues Press Release.

Unmarried and Deceased Taxpayers.

. You andor your spouse are liable for Pennsylvania tax on your income. However we also received 40k in Social. What is Tax Forgiveness.

Provides a reduction in tax. To receive tax forgiveness a. What is a Pennsylvania tax forgiveness credit.

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. Record tax paid to other states or countries.

Form PA-40 SP requires. At the bottom of that column is the percentage of Tax Forgiveness for which you qualify. Provides a reduction in tax liability and.

Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability. Eligibility income is greater because it includes many nontaxable forms of income such as interest on savings. However any alimony received will be used to calculate your PA Tax Forgiveness credit.

Governor Tom Wolf today reminded Pennsylvanians that student loan borrowers who will receive up to 20000 in relief. ELIGIBILITY INCOME TABLE 1. For taxpayers who earn a wage the employee.

The Pennsylvania Tax Forgiveness Credit is a credit that allows eligible taxpayers to reduce all or part of their tax liability to PA. To claim this credit it is necessary that a taxpayer file a PA-40. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability.

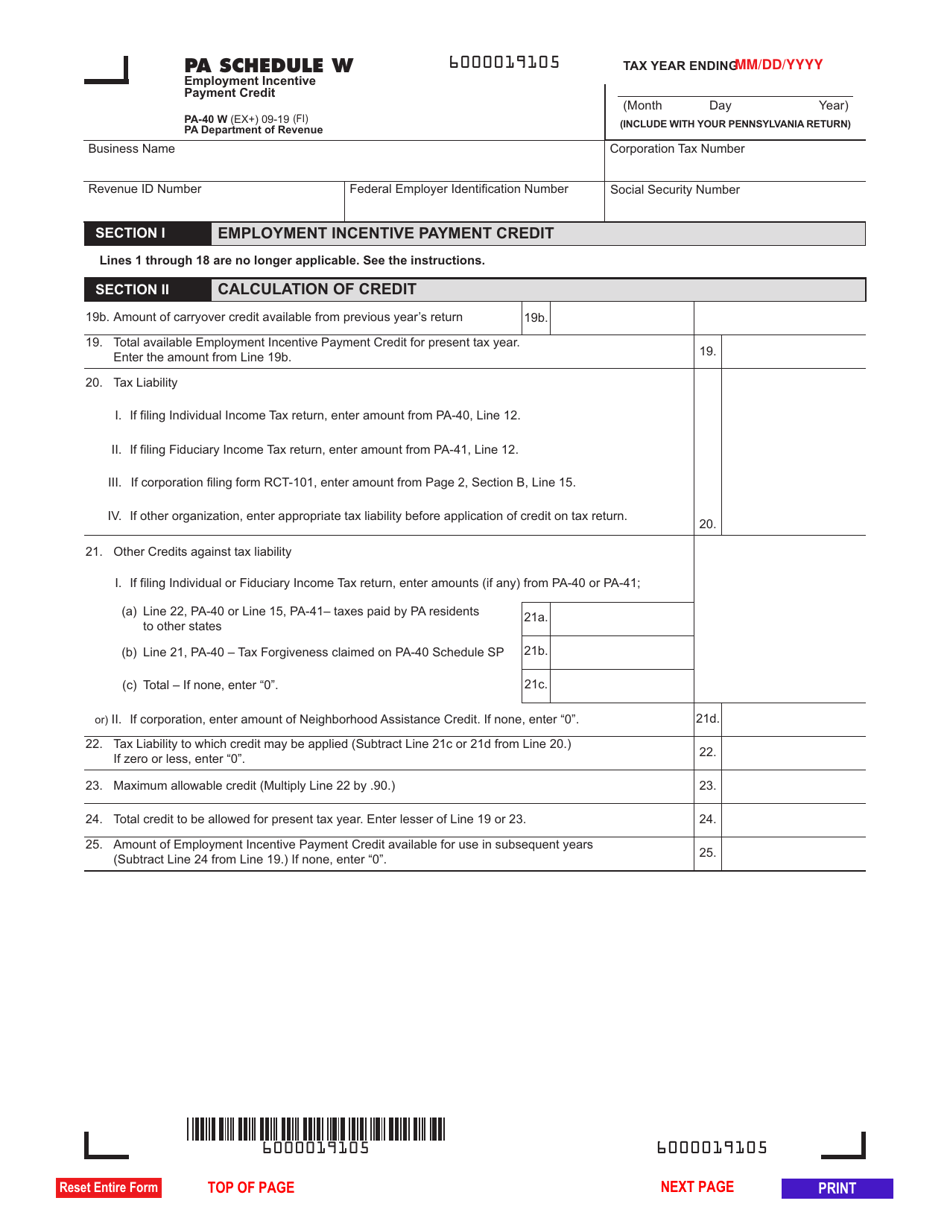

Where do I enter this in the program. Use PA-40 Schedule SP to claim the Tax Forgiveness Credit for taxpayers who meet the qualifications to reduce all or a part of their Pennsylvania Tax Liability. TurboTax indicates that we are eligible for the PA Special Tax Forgiveness Credit for 2021.

Alimony- Alimony payments that you received are not taxable in the state of Pennsylvania. Depending on your income and family size you may qualify for a refund or reduction of your Pennsylvania income tax liability with the states Tax Forgiveness program. Eligibility income for Tax Forgiveness is different from taxable income.

The qualifications for the Tax Forgiveness Credit are as follows. The Tax Forgiveness program allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. The PA earned income was 9100.

You are subject to Pennsylvania personal income tax. The Tax Forgiveness Program allows low income taxpayers to either reduce or eliminate their tax liability through tax forgiveness credits. The Pennsylvania Tax Forgiveness Credit is a credit that allows eligible taxpayers to reduce all or part of their tax liability to PA.

Provides a reduction in tax liability and. Record the your PA tax liability from Line 12 of your PA-40. In Part D calculate the amount of your Tax Forgiveness.

Form Pa 40 Fillable 2013 Pennsylvania Income Tax Return Pa 40

Good News Pennsylvania Won T Tax Your Student Loan Forgiveness After All Pennlive Com

Pennsylvania Will Not Tax Student Debt Forgiveness Witf

Form Pa 40 Schedule W Download Fillable Pdf Or Fill Online Employment Incentive Payment Credit Pennsylvania Templateroller

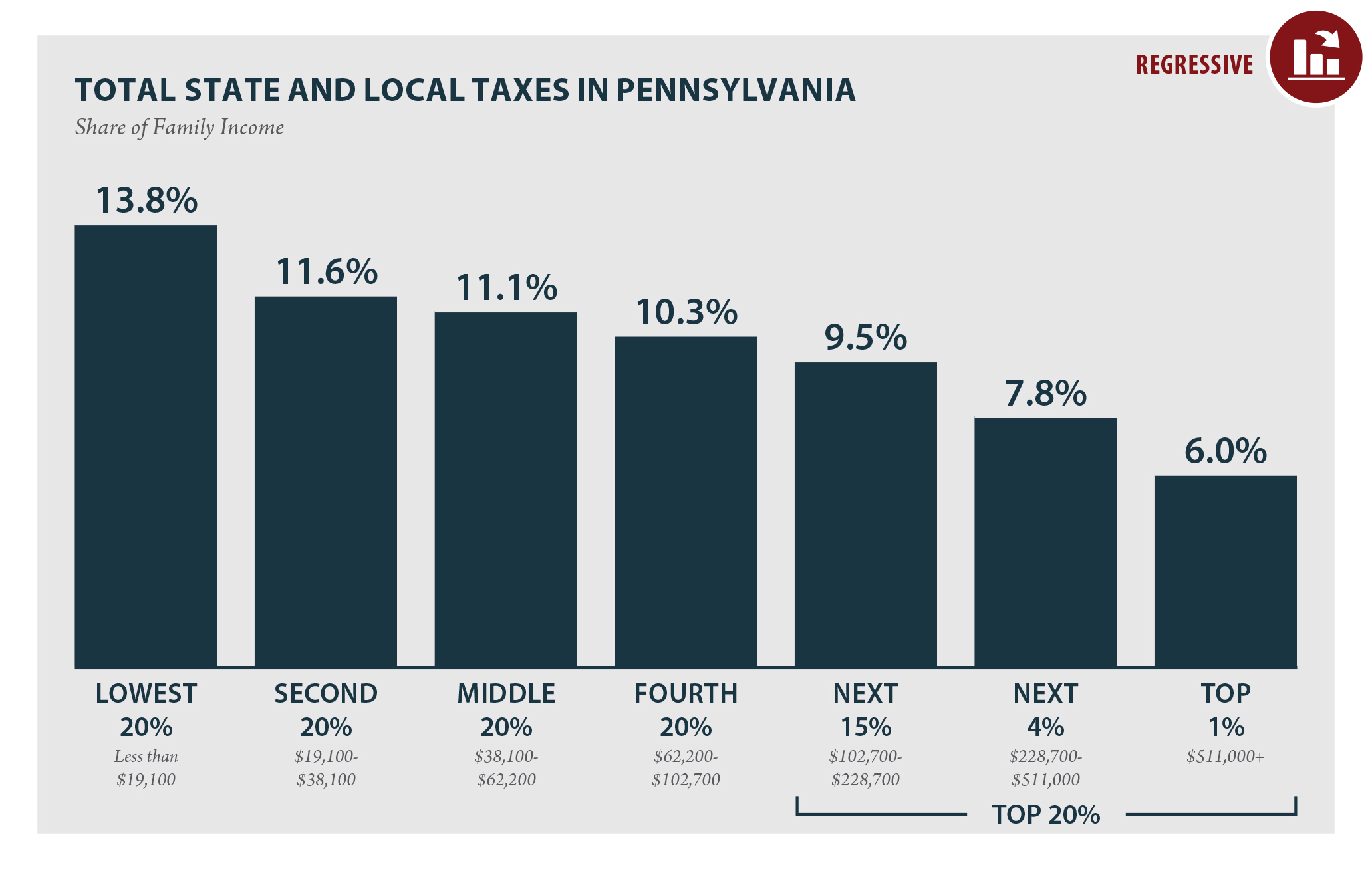

Pennsylvania Who Pays 6th Edition Itep

Pa Income Tax Refunds Are Available Find Out If You Re Eligible

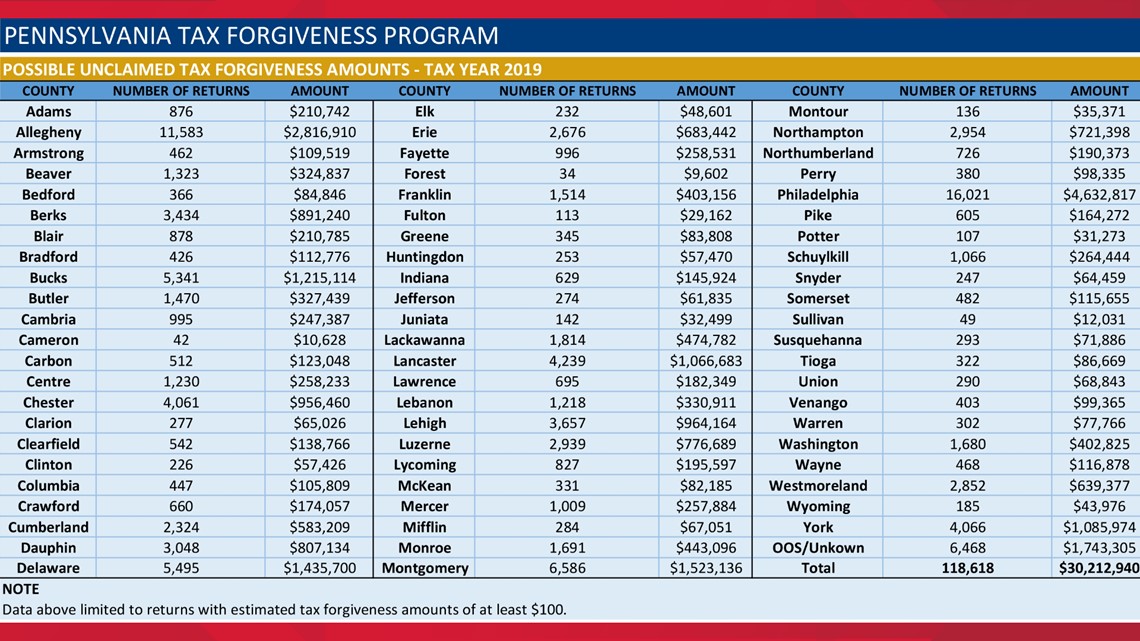

Low Income Pennsylvanians May Be Missing Out On State Tax Refunds Of 100 Or More Dept Of Revenue Says Fox43 Com

How Does The Ppp And Erc Affect The R D Tax Credit

Prepare And Efile Your 2021 2022 Pennsylvania Tax Return

Pa House Passes Bills To Address Firefighter Shortage By Offering Property Tax Credits College Loan Forgiveness And More Pennlive Com

Fillable Online 2000 Pa Schedule Sp Special Tax Forgiveness Credit Pa 40 Sp Forms Publications Fax Email Print Pdffiller

Senator Lindsey M Williams Releases Statement On Federal Student Loan Forgiveness Tax Status Pennsylvania Senate Democrats

Pennsylvania Special Tax Forgiveness Credit Do You Qualify Supermoney

Estate Gift Tax Considerations

Student Loan Forgiveness No Longer Taxable In Pennsylvania Pennsylvania Thecentersquare Com

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania

Form Pa 40 Fillable 2013 Pennsylvania Income Tax Return Pa 40

Fully Remote Worker Income Tax Withholding Considerations Rkl Llp

:max_bytes(150000):strip_icc()/GettyImages-1298373281-1d675f87d7884d97b6973e8d234247d9.jpg)