starting credit score canada

For example if the total credit limit across all your accounts is 10000 and you have a. Using CreditWise to keep an eye on your credit wont hurt your score.

Build Credit With A Secured Credit Card Capital One

In TransUnions view a score that is above 650 will likely allow you to receive a standard.

. Get a credit card. You can read our pick of the best newcomer bank accounts here. This refers to how much of your available credit youre using.

It tells potential lenders how well you manage debt and credit. Once you have credit the single biggest thing you can do to improve your credit score. An excellent way to start building your credit score is with a credit card.

Its an easy way to start working on a credit file use your card to make payments. Money that doesnt belong to you. Is your personal online credit score the same credit score lenders use to assess your loan application.

Credit scores range from 300 just getting started 650 the magic middle number. Your credit history is the financial record of how you. And its free for everyone not just Capital One customers.

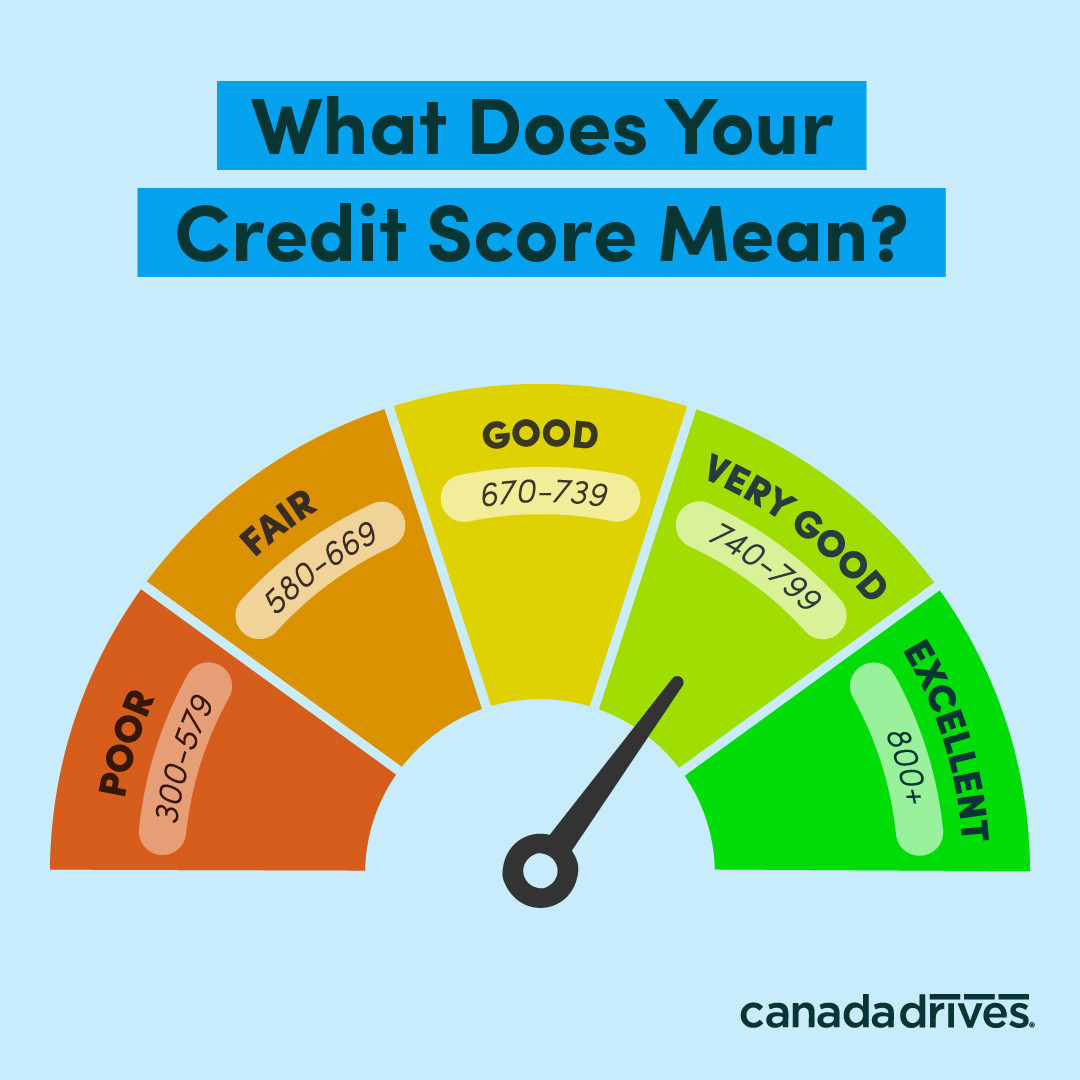

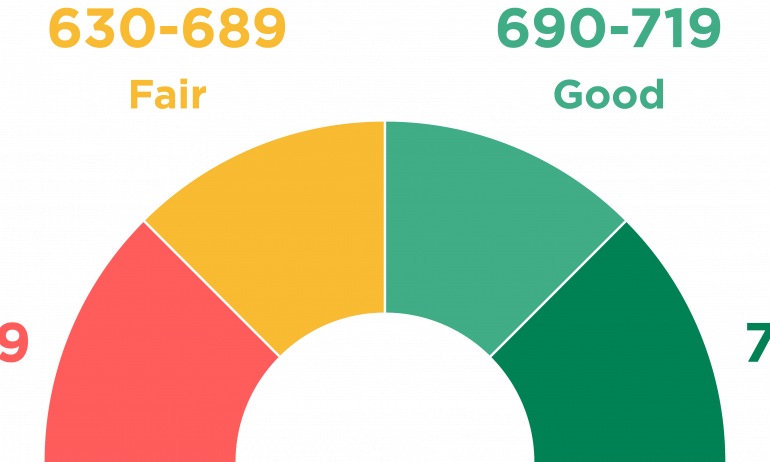

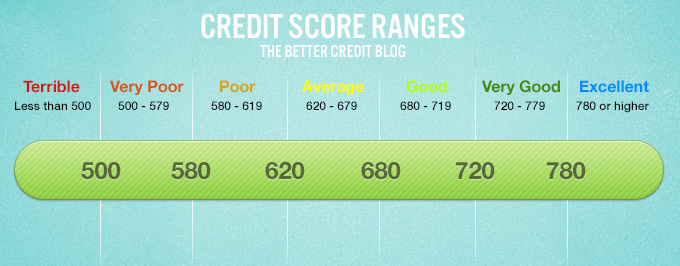

Differences Between American vs. In Canada credit scores range between 300 and 900 with a higher score being better. The higher the score the.

A credit score is a number on a scale of 300 to 900. How does a credit score in Canada actually work. Learn more about how your credit score is calculated.

You can access your credit score online from Canadas 2 main credit bureaus. Most peoples credit score doesnt start at the. You can also get free copies of your credit.

Credit utilization ratio. Since credit scores range from 300 850 300 could be considered the starting score. However the starting credit score isnt zero.

A credit score is essentially a numeric rating that banks lenders use to qualify you for a loan. As a resident of Canada you will automatically begin building a credit history once you start using credit in the country. To understand how credit score and missed payment trends across Canada have changed during COVID-19 measures Borrowell a fintech company that offers free weekly credit score updates analyzed credit scores and credit reports of 1015369 Canadians including those in 20 of the largest cities in Canada from Q1 2020 to Q1 2021.

In Canada you will get credit scores as high as 900 points as a simple starting point. Pay your bills on time. According to TransUnion credit score ranges are categorized as follows.

Your credit score from Equifax is accessible online for. Canadian credit scores range from 300 on the low end to 900 on the high end whereas credit scores in the US.

What Is A Credit Score How Is It Calculated In Canada My Money Coach

:max_bytes(150000):strip_icc()/how-long-it-takes-to-build-good-credit-4767654_final-5b370f861f4f42e5975e63c6bbeb2784.gif)

How Long It Takes To Build Good Credit

The Top 5 Secured Credit Cards For Boosting Your Credit Score

How To Get A Credit Score In Canada As A New Immigrant

What Is A Good Credit Score Td Canada Trust

What Is Considered Bad Credit Legacy Auto Credit

What Is A Good Credit Score Nerdwallet

How To Raise Your Credit Score By 100 Points In 45 Days

560 Credit Score How To Improve Your 560 Credit Score

What Is The Average Credit Score In Canada And How Do You Compare

How To Improve Your Credit Score Lendingtree

Credit Scores Credit Reports Credit Check Transunion

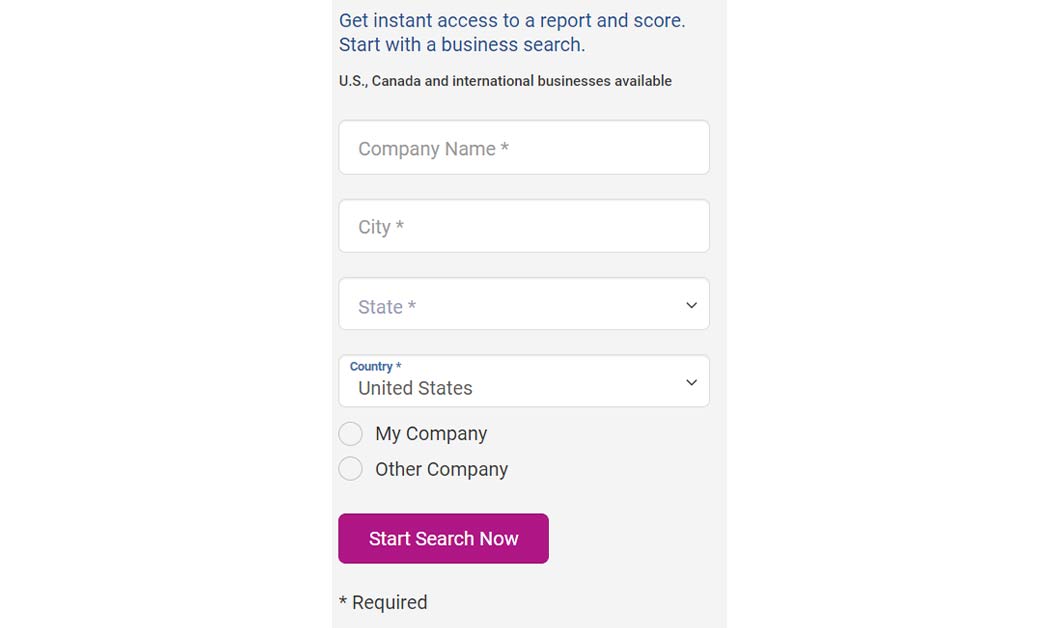

How To Check Your Business Credit Score Plus Key Tips

What Credit Score Do You Start With In Canada

What Credit Score Do You Start With Mintlife Blog

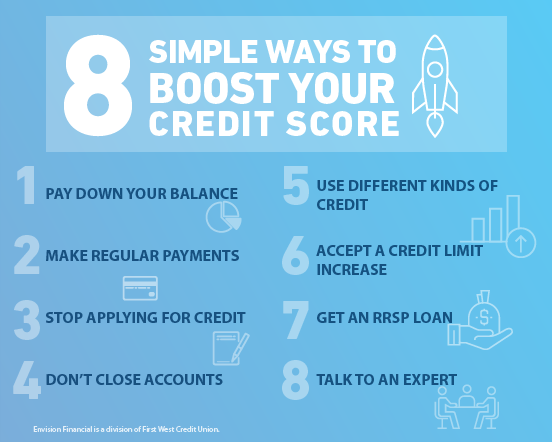

Understanding Your Credit Score And Why It Matters Envision Financial

Business Credit Report Run A Free Company Search Experian

Best Credit Cards For Credit Score 600 649 Fair Credit

When Were Credit Cards Invented The History Of Credit Cards Forbes Advisor